What The V Curve Reveals About Stalled Growth In Businesses

4 main factors that explain why your business is going through growth stall!

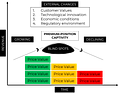

Research conducted by Matthew S. Olson, Derek van Bever, and Seth Verry on over 500 companies and two decades' worth of data has revealed crucial patterns in the growth and stall of firms, including top-performing companies. In this article, I will highlight four factors they identified, which I have incorporated into a model called the V Curve of Growth Stall.

FIRSTLY, WHAT IS UNEXPECTED IS SUDDEN BUT NOT UNEXPECTED

“How did you go bankrupt? "Two ways. Gradually, then suddenly.” - Ernest Hemmingway

These lines from Ernest Hemingway’s novel The Sun Also Rises, reveal a lot about the human experience when it comes to success and failure. There’s pain and shock when the world collapses beneath our feet. Then we realise that this outcome was quite predictable.

It does not matter if your business was doing fine yesterday. What matters is; whether it can continue to do the same tomorrow.

SECONDLY, MAJOR REASONS FOR DOWNFALL ARE WITHIN MANAGEMENT’S CONTROL

Success breeds its destruction, and organizations that experience stagnant growth have had a crucial hand in their decline. Organizational psychology sheds light on the major contributing factors, such as cognitive biases and overconfidence, which are within management's control. The three primary factors are:

STRATEGIC CAPTIVITY, which results in limited options due to the management's choices about strategy. Companies growing while serving a few significant customers may create cost trade-offs and raise risk exposure.

BLINDSPOTS, which emerge as a result of success and cause ignorance of changes in the external environment and self-confirming biases that everything is fine. Ironically, just before the decline, companies tend to grow the most, as found by Mathew, Derek, and Seth's research.

MISJUDGEMENT, can result in unrealistic expectations of the market, overconfidence in the company's ability to innovate or compete, underestimating the competition, or miscalculating the resources needed to execute their growth strategy. Misjudgment may constitute a mixture of internal and external factors, but it is largely within the management's control.

THIRDLY, THE FALL IS OFTEN ON THE BACKS OF INFLECTION POINTS

Companies that experience stagnant growth often overlook an important strategic point where something major has happened in technology, customer needs, regulations, or economic conditions. It may be because companies are often trapped in strategic captivity, blind spots, or misjudgment. Missing an inflection point can upend the price-value equation, resulting in strategic breakdown.

FOURTHLY, EXTERNAL CHANGES MULTIPLY THE EFFECTS OF STACKED VARIABLES THAT CAN CAUSE A DECLINE

Stalled growth companies struggle to execute turnarounds because external environmental changes often result in multiple variables such as:

Cash

Customer segments

Cost

Utilization

Consumption Patterns

Demand

Stacked variables cause price-value dynamics to shift and strain organizational resources while creating uncertainties in market positioning. The effect of these variables demands a serious strategy re-adjustment, often resulting in a transformation program to overhaul the company's decline.

It is possible to protect your organization from getting on the V curve, and it is best described in Jeff Bezos's quote to his shareholders:

“Staying in Day 1 requires you to experiment patiently, accept failures, plant seeds, protect saplings, and double down when you see customer delight”.